Sprouts Farmers Market: Trading Lower Despite Long-Term Growth Prospects (NASDAQ:SFM)

krblokhin/iStock Editorial by way of Getty Visuals

Financial investment Thesis

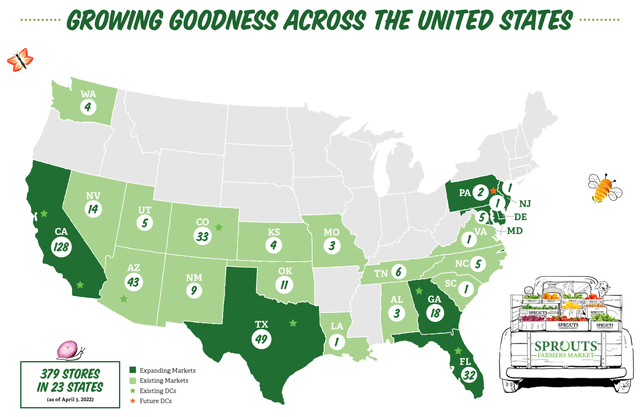

Running across 23 states with a full of additional than 380 locations, Sprouts Farmers Sector (NASDAQ:SFM) specializes in providing all-natural and natural foods selections to buyers in the continental United States largely south of Pennsylvania. Soon after their Q1 earnings report projected weaker limited-expression effectiveness than anticipated in light-weight of inflation-driven sales decline, Sprouts saw share costs minimize from a high of $35 in April to as minimal as $23 in May well. Currently, as share prices remain all over $25 for every share, traders seem to be far more targeted on limited-expression elementary tailwinds than what management is accomplishing to build lengthy-expression shareholder value. Presented increased purchaser retention rates, the expected boost of shop destinations is poised to fight scaled-down units per basket figures heading into the future. Increase in the strong probability that management will proceed share buybacks in the vicinity of expression, Sprouts Farmers Market place appears to be an impressive lengthy prospect.

Q1 Earnings Market-Off

To start with-quarter earnings introduced each excellent and lousy news exclusively, a defeat in earnings for each share and an regrettable, but extremely shut, pass up in conditions of profits. The $8.55M miss in profits is unlikely the culprit for the stock’s additional than 25% minimize from the times of earning, only some of which has been regained in the earlier month or so. As an alternative, what appeared to have brought most of these losses was a considerable Financial institution of The united states downgrade to less than-perform from a buy score. On best of this slight pass up in income and a unexpected double-downgrade from analysts, steerage from administration did not seem to be to provide any instant reduction from these in depth losses. Following an update that this year’s total gross sales expansion would be around the decreased end of assistance issued in February, Chief Economical Officer Chip Molloy would comply with that up by stating:

For the next quarter, similar gross sales really should be near to flat and earnings per share is predicted to be amongst $.49 and $.53.”

In listening to that neither income development nor earnings will improve considerably in the close to expression, a decrease in share selling prices, which had been then investing about 15 times earnings, was comprehensible. However, during that exact same Q1 earnings simply call, management talked about quite a few catalysts which are probable to incorporate shareholder benefit in the very long phrase, a thing that is specially interesting now that Sprouts is buying and selling at fewer than 12 times its earnings.

Foreseeable future Expansion Trumps Limited-Expression Tailwinds

With management’s aim on expanding areas through the nation, beating a loss of income owing to a slight decrease in device product sales per basket is quite most likely supplied higher consumer retention costs. In comparison to last 12 months, when revenues ended up at their optimum, fewer things are staying placed in carts and this minimize in product sales, according to Main Executive Officer Jack Sinclair, can be attributed to the two an boost in travel as perfectly as inflationary considerations among consumers. Regardless of this reduction, the addition of six merchants all over the to start with quarter and designs to add 15-20 suppliers in the course of 2022 inside of developing markets such as California, Texas, Florida, and Pennsylvania, appears to supply an chance to make up this loss profits. This is backed by the addition of 34 new places through 2020 and 2021, representing no indicator of slowing down likely forward, specifically as the natural meals marketplace continues to increase at a CAGR of 12.2%.

Sprouts Farmers Sector Spots and Rising Marketplaces as of April (Q1 Earnings Simple fact Sheet)

Aiding this raise in store depend make up for a decline in units for each basket is the good craze in shopper retention. Talking on the strengthening relations with their buyer base in the Q1 earnings connect with, CEO Jack Sinclair shared the next:

We go on to see our customer engagement develop from a electronic standpoint with raises in account signal ups, active e-mail customers and tech subscriptions. We also saw beneficial traits in purchaser retention fees, although our client gratification scores remain incredibly high (Q1 Earnings Call).”

Their capability to sustain loyal prospects, in particular for the duration of continued growth, will help in bringing earnings back to all-time highs, as will the steady earnings margin of 37.3% which beats out several of their (more substantial) competition. For comparison, Albertsons (ACI), Walmart (WMT), and Costco (Expense) have gross profit margins of 29%, 25%, and 12%, respectively. Assuming that competitive edge, possible deriving from the mostly-organic merchandise collection customers are inclined to spend added dollars on, carries on, Sprouts will be in an even improved place to make use of these more places and generate future earnings.

Outstanding Usage of Income Movement

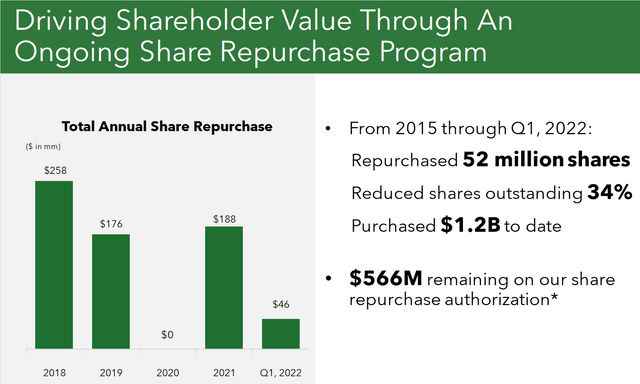

Over and above an rising spot rely, Sprouts Farmers Current market has also utilized their large dollars circulation to carry out a variety of share buybacks in an work to generate shareholder benefit, all while signaling that they are believers that share selling prices are undervalued. Specifically with the large stages of hard cash on hand appropriate now (close to $324M), their authorization of $600M in further more share buybacks continues what has so considerably introduced shares outstanding down by 34% according to their Q1 earnings presentation:

Sprouts Farmers Sector Repeated Observe of Share Buybacks Seems to Continue Incorporating Worth (Q1 Earnings Deck)

Thinking about that really tiny of that $600M repurchase authorization has been exercised, with where by share selling prices stand nowadays, it is probably that Q2 earnings (expected July 29th) and upcoming studies will go on this favorable pattern in decreasing shares outstanding and growing shareholder benefit.

Overcoming Inflation-Relevant Hazard

Inflation is, and has been, a crucial concern for investors not only in Sprouts but in most each financial investment accordingly, the current decline in Sprouts’ share price tag can be attributed to the slowed development that was brought by inflation’s effects on customer traits. As management regularly produced mention of all through their earnings contact, clients across shops were decreasing the number of products in their carts and this was mostly attributed to the inflationary effects experienced on much more-high-priced, organic, food items. Taken from the Q1 earnings contact:

Inflation is not slowing and consumers go on to set 1 to 2 much less goods in their basket this yr than very last (Q1 Earnings Simply call).”

Despite the slight reduction in things ordered for every transaction, I anticipate this craze of fewer items in one’s searching cart to get no worse as inflation either worsens or remains related to wherever it stands right now. I arrive to this conclusion by using Engel’s Legislation which posits a greater proportion of one’s profits is devoted to food stuff expending as their income decreases, a thing quite a few are coming to realize as their purchasing electricity decreases with inflation.

Technological Rebound in The Generating

The quarter just one announcement that earnings in the quick-phrase will very likely be on the lower conclude of estimates led a lot of buyers to near their positions with no noticing the lengthy-term expansion possible that is even now in retail outlet for Sprouts Farmers Industry. Pushed by the continued addition of spots nationwide in addition to a bigger ability to keep new shoppers, share costs need to proceed their very long-term trend in just a bullish channel as get in touch with with the lower assistance line repeats. With an expectation that this line will not be surpassed thoroughly, opening a lengthy posture in the sub-$26 region seems to give an great option.

Price tag motion appears bounded by a bullish channel. MACD and 200 MA Bundled. (TradingView)

Adding in the Going Ordinary Convergence Divergence approaching the baseline (signaling a opportunity bullish development in the building), Sprouts Farmers Markets seems to be in a great spot for a rebound. Assuming that share charges reflect off the revealed assistance line, investors should really also choose take note of the 200-working day moving normal which could act as a upcoming line of resistance on the other hand, previously in that lengthy channel, this going regular line has been surpassed.

Ultimate Feelings

Sprouts Farmers Market place, adhering to considerations from its Q1 earnings report about limited-term general performance, has observed share price ranges far too far removed from the worth that will be produced as a consequence of more shops, extraordinary retention, and share buybacks. In its latest bearish activity, each and every of these catalysts which are most likely to develop shareholder benefit have been ignored and are nonetheless to be sufficiently priced in. Expecting a complex rebound to initiate a share price tag rebound in the near-time period, larger fundamentals will even more this overall performance into the lengthy time period as this kind of, I see a sturdy likelihood for shares to return to their all-time highs and additional. With that, a verified means to mature in current financial circumstances and a strong monitor history of returning shareholder price, Sprouts Farmers Industry seems to be to be an incredible very long possibility for individual investors.