Largest independent broker-dealers saw fee revenue surge last year

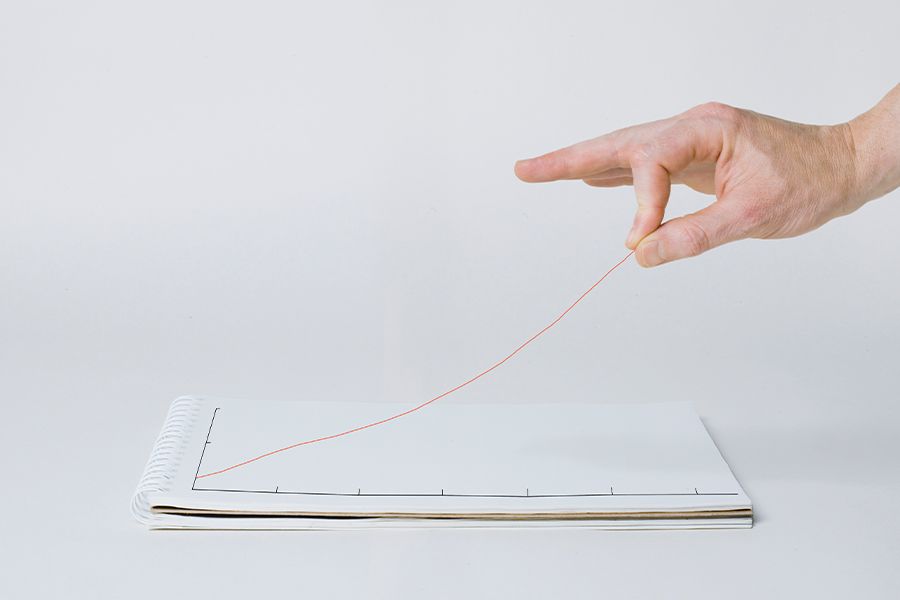

Impartial broker-sellers, so termed since they pay advisers as independent contractors and not staff members, continued to see a surge in earnings previous calendar year from advisers charging clientele charges, a noteworthy accomplishment for an field that significantly less than a 10 years saw the the vast majority of its revenue derive from commissions on the profits of products.

Certainly, the rising tide in earnings from expenses, which corporations normally charge shoppers primarily based on assets and prior to the start of a new quarter, was so robust amongst the largest impartial broker-dealers that in 2021 service fees comprised 54% of profits from the major 25 broker-dealers in this year’s InvestmentNews survey. In the meantime, revenue from commissions was 34% and other profits, mainly created from curiosity-level spreads, was 12%.

Those people InvestmentNews calculations do not seize the overall IBD marketplace: They exclude firms that didn’t disclose particular person income segments, and the checklist differs from calendar year to yr since some companies select not to report.

But the change by IBDs charging fees and hunting much more like the level of competition — registered expenditure advisers — cannot be ignored. For extra than two a long time, the brokerage field has touted how it was likely to change to a fee-based small business product, which was a lot less unstable than the up-and-down cycles of gross sales of superior-fee goods like variable annuities and nontraded real estate expense trusts.

“All I can say is, appreciate it whilst it lasts,” stated Jonathan Henschen, an marketplace recruiter. “We could quite properly be coming into a money derecho, or windstorm, with the probability of negative information significantly outweighing good news as the Fed commences economical tightening in order to struggle inflation.”

ACCELERATED Aim

Regulation Greatest Curiosity is accelerating advisory emphasis and generating fee enterprise ever more challenging and bureaucratic to transact, Henschen extra. “We are getting to be an market of every person being targeted on advisory as broker-supplier earnings facilities have positioned advisory business as their key earnings generator.”

It appears that change has taken hold and lately accelerated throughout the Covid-19 pandemic. Final 12 months, for the initial time considering that InvestmentNews started its study, the major 25 companies described that fee profits manufactured up 50% of their full earnings on common.

Buoyed by much more revenue on common from charges and very last year’s roaring inventory current market — the S&P 500 posted a overall yearly return, together with dividends, of 28.7% — the top rated 25 impartial broker-dealers saw one more milestone, for the initial time tallying profits of $33.9 billion, a 24.7% boost about 2020, when revenue among the team totaled $27.2 billion.

And previous year’s income development for the top unbiased broker-dealers was welcome information for the industry as it struggled to retain functions in the course of the pandemic a yr previously, InvestmentNews described yearly income expansion for the top rated 25 corporations of just 4.3%.

2021’s IBD success are almost the mirror reverse of the profits breakdown for the main IBDs in 2013, when commissions accounted for 52% of profits and charges 34%, with so-identified as “other” profits at 14%.

The sale of solutions for commissions has confronted significant headwinds, market executives famous, such as lower price brokers reducing commissions for some trades to zero starting up in 2019 and a new regulatory regime from the Securities and Trade Fee, identified as Regulation Most effective Interest.

“The change to payment organization has been 20 yrs in the building, suitable?” reported Dennis Gallant, senior analyst with the Aite Group. “It’s not like it is a new effort by the IBD field, but the firms actually ramped up cost-based mostly company and property five a long time back. That’s when the Division of Labor’s fiduciary rule was hanging over them, and now Reg BI is adding to that.”

“And there is also the aggressive trends driving this, with the progress in the guidance industry using off on the RIA facet of the industry,” he reported.

RIAs charge consumers service fees based mostly on property whilst broker-sellers, in the regular design, cost commissions for transactions. Now a hybrid small business design exists for IBDs, but advisers who demand clients fees on assets are evidently the most attractive for companies, Gallant claimed.

And smaller sized broker-sellers are nevertheless battling with scale and economics in an sector that has observed extreme mergers and acquisitions and consolidation around the past 10 years. “There’s far more levels of competition experiencing everybody,” he added. “The buyer would like economical suggestions but has extra selections and solutions than at any time.”

Firms weren’t the only groups benefitting in an fantastic 2021. Economical advisers at independent broker-dealers are thriving, too.

According to InvestmentNews information, past yr financial advisers at 6 impartial broker-sellers made far more than $500,000, on average, in charges and commissions, acknowledged as gross seller concession or GDC in the business. That is three times the amount of companies that reported once-a-year normal revenue for each adviser higher than $500,000 in 2020.

The industry’s best-producing money advisers do the job underneath the roof of Commonwealth Money Network, which has a platform that includes an RIA-only possibility for its advisers. Very last yr, Commonwealth Financial Network’s advisers, on average, generated $769,000 in yearly profits, an enhance of 22.3% in contrast to a 12 months previously, when its advisers made $629,000 on common.

“I don’t forget the days when most companies were hovering at $200,000 of GDC for each adviser, and now 50 percent a dozen are at extra than $500,000,” explained Jodie Papike, president of Cross-Lookup, a 3rd-bash recruitment organization. “That’s amazing. It shows what natural, once-a-year progress has become for advisers who stayed the class around the earlier 10 a long time.”

And so significantly in 2022, despite the S&P 500 remaining down a tiny more than 8% as of the end of investing on April 11, the IBD market could see a welcome enhance to profits from increasing fascination costs. That is great news for the securities business as a entire, which expenses clients fascination for borrowing on margin and captures the desire-rate unfold on the money clientele maintain in revenue market place accounts.

In March, the Federal Reserve elevated limited-expression curiosity fees by a quarter issue, the first Fed rate hike considering the fact that 2018. Additional fee hikes are anticipated.

“We’ve up to date our economic types because of to curiosity charges and since of favourable rates for internet fascination margin,” said John Pierce, head of small business growth at Cetera Money Team.