Lowe’s: Great Business, But Headwinds Persist (NYSE:LOW)

jetcityimage/iStock Editorial through Getty Illustrations or photos

Lowe’s (NYSE:Minimal) has been a person of our favorite inventory picks in the recent decades. Lowe’s not only grew its revenue and web cash flow, but also managed to increase its margins, get again shares, and return price to its shareholders in the form of dividend payments.

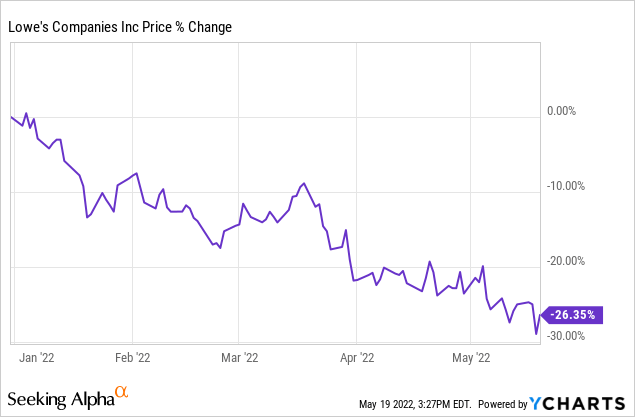

Though in Lowe’s most current quarterly report some of the financial figures appeared promising, we believe there could possibly be some probable headwinds in the in close proximity to-time period.

Let us to start with get a glance LOW’s Q1 figures.

Initially quarter financials and operational outlook

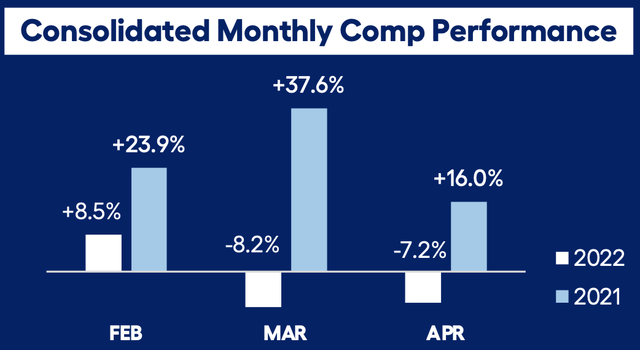

Lowe’s has reported complete gross sales of $23.7 billion in Q1 2022, in comparison to the $24.4 billion in the 12 months ago quarter. Similar profits have lowered by 4%, largely because of to the lower in sales of the U.S. dwelling enhancement small business segment. The organization has stated the decline in revenue by the unusually chilly temperatures expert in March and April this 12 months, impacting the mostly the Do it yourself purchaser base.

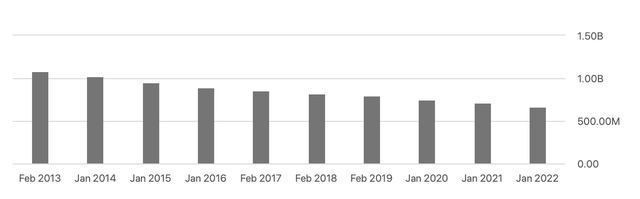

Consolidated month-to-month comp efficiency (Macrotrends.web) Earnings (Lowe’s)

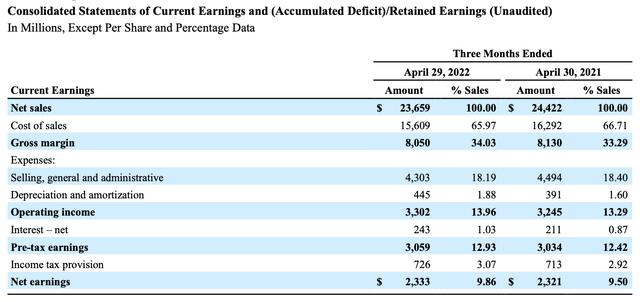

The fall in revenue was offset by the increasing functioning margin, enabled by the firm’s “Complete Household” tactic and their “Perpetual Productivity Enhancement” initiatives. The company claimed EPS $3.51, up by additional than 9% as opposed to the yr back quarter.

Also a proof of LOW’s nicely-performing company model is that the agency has managed to persistently maximize its return on belongings (ROA) above the very last decade.

ROA (Macrotrends.web)

In our view, LOW’s economic outcomes and unmodified outlook for 2022 seems encouraging however, we believe that there could possibly be macroeconomic headwinds in the around phrase, mainly owing to improved input prices and labor shortages. So far, Lowe’s has proven that even in this inflationary atmosphere, they can properly develop their margins. Looking ahead, the property advancement sector is anticipated to continue being robust and the running margin is also forecasted to grow even further in 2022.

Valuation

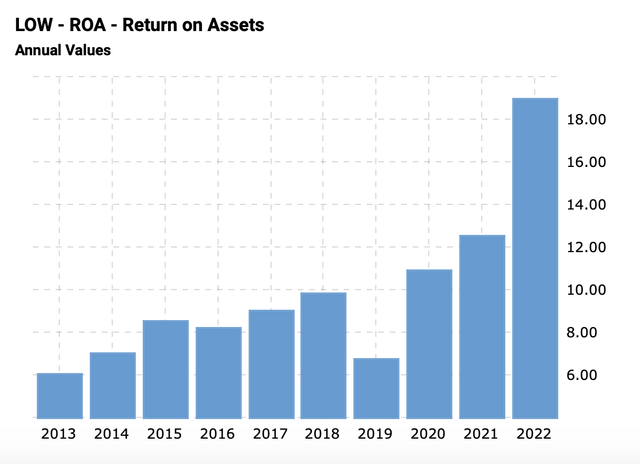

Lowe’s stock, just like lots of others, has been strike quite really hard in 2022, ensuing in a more than 26% drop yr to day.

Lowe’s surely appears to be a lot more eye-catching now than 6 months in the past.

But to choose regardless of whether this could be a fantastic entry stage, we have to get a closer look at some of the traditional selling price multiples evaluating them with the sector medians and also with Lowe’s 5-yr averages.

The TTM price to earnings ratio of Lowe’s is somewhere around 15, about halfway among the sector median of 11 and its 5-12 months historical ordinary of 20. In phrases of EV/EBITDA and P/CF the agency is also buying and selling at a top quality compared to the sector median, but at a lower price in comparison to its personal 5-calendar year historic ordinary.

In our viewpoint, the current price tag multiples are justified for 4 motives:

1.) Dividend

Lowe’s has been shelling out and escalating its dividend in the final 58 decades. The present dividend generate is approximately 1.7% or quarterly $.8 per share. We imagine this dividend is sustainable, as the payout ratio at this time is about 24%, below equally the sector median and its very own 5-yr historic ordinary.

2.) Share buybacks

The company has been fully commited to obtaining back shares repeatedly in the last a single 10 years. They have diminished their selection of shares excellent by as substantially as 40%. In the very first quarter of 2022, the firm has repurchased 19 million shares for a complete of $4.1 billion.

Share exceptional (Seekingalpha.com)

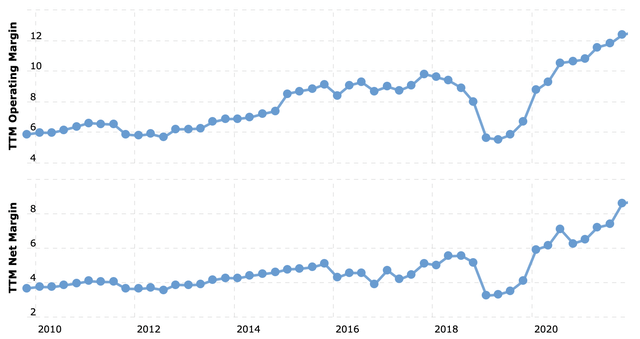

3.) Increasing margins

In the last a long time, Lowe’s has not only improved its revenue, but also managed to broaden its margins. In our see, enhancing running and web margins sign a constructive improvement of the firm’s efficiency and profitability.

Margins (Macrotrends.internet)

4.) Forecasted advancement

In accordance to analysts’ estimates, earnings per share typical in the subsequent 4 quarters is envisioned to be $13.52, representing a additional than 12% improve compared to the EPS of $12.04 in the past 4 quarters.

We believe these forecasts are encouraging in gentle of the probable macro headwinds, together with tight labour sector and expanding labour charges, in the close to expression.

All in all, we imagine that the valuation of Lowe’s at these value degrees is affordable. Whilst further more volatility could be in advance, this could be an interesting entry level for buyers looking for reasonable progress, sustainable dividends, and benefit as a result of share buybacks.

Pitfalls

Just before concluding our overview, we want to emphasize some of the crucial dangers pointed out in Lowe’s annual report.

1.) Rapidly evolving retail setting

In our feeling, a lot of of the shops in the initial quarter, including Walmart (WMT) and Focus on (TGT), unsuccessful to handle the transforming desire and searching behavior of their prospects. Despite the fact that Lowe’s is not straight similar to WMT or TGT, in turbulent occasions, with climbing inflation all stores have to shell out close notice to the behavioural improvements of their clients. Failing to tackle change could likely damage not only earnings but could also direct to declining stock turnover or even to obsolete inventory.

2.) Tight labour industry

The latest labour marketplace in the United States is extremely aggressive. A lot of businesses have been struggling in the 1st quarter of 2022 to recruit, train and keep employees. If Lowe’s fails to employ the service of and retain the correct range of workers, they may perhaps have issues with supplying the clients a unique and a lot more personalised encounter. Also, the increasing labour expense could have damaging influence on the firm’s earnings.

3.) Cooling housing industry in the United States

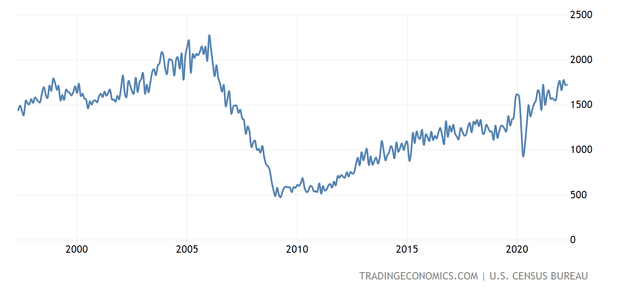

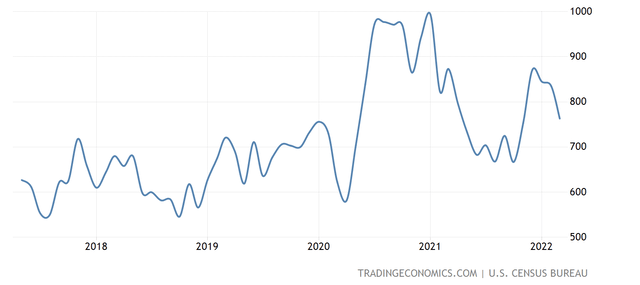

Even though the housing starts off in the U.S. nonetheless seems to be somewhat robust, there has been a slight decline equally in March and April in the new housing starts.

Housing starts off (tradingeconomics.com)

The three most important headwinds for the housing marketplace are: significant property finance loan prices, growing content charges and provide chain constraints. This standard economic uncertainty may negatively affect Lowe’s monetary performance in the in the vicinity of term.

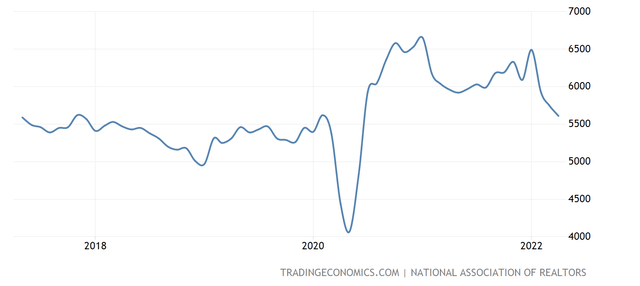

Even further, equally the new properties profits and the current dwelling profits have declined sharply in the previous number of months.

Present home profits (tradingeconomics.com) New residence gross sales (tradingeconomics.com)

In our opinion, this craze is not likely to reverse in the close to phrase, when substantial product charges, offer chain constraints and higher house loan fees persist.

Our takeaways

Stable money efficiency in the first quarter, with growing EPS and operating margins.

Beautiful valuation right after a important drop in the share price tag yr to day.

Cooling housing current market can build short-term headwinds for Lowe’s.