Flushing Financial Stock: Low-Risk Loan Book With A 4% Dividend Yield (NASDAQ:FFIC)

stefanopolitimarkovina/iStock Editorial through Getty Images

Introduction

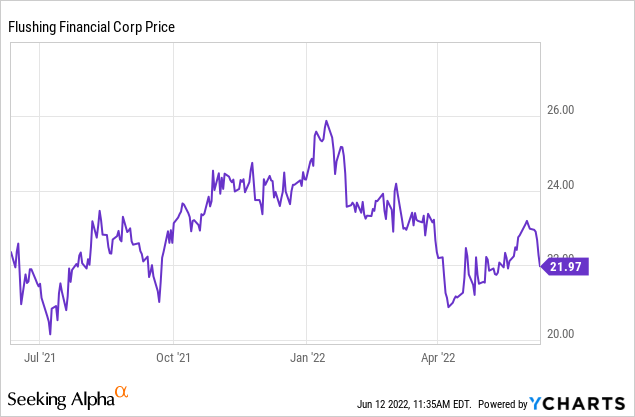

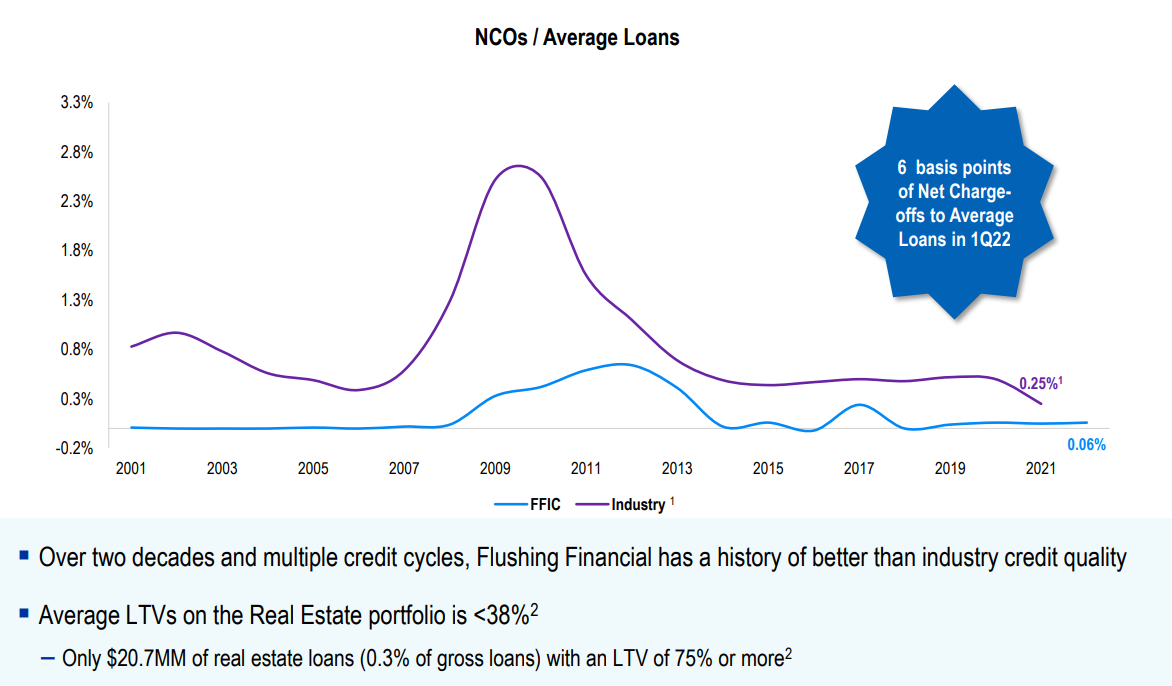

In a past post on Flushing Economical (NASDAQ:FFIC), I was in awe of the very robust personal loan portfolio owned by this New York focused bank. The common LTV ratio of the genuine estate loans was considerably less than 40% which in principle implies that even if the benefit of the fundamental home drops by 60%, the lender should really be equipped to walk absent without having any decline. Of training course some loans have higher LTV ratios than other loans but to see an typical of significantly less than 40% is absolutely impressive (and only .3% of the financial loans have an LTV ratio exceeding 75%). I have been holding an eye on the lender since then and I continue to be impressed with how this rather compact lender is operate.

Robust benefits in the 1st quarter, with extremely reduced bank loan reduction provisions

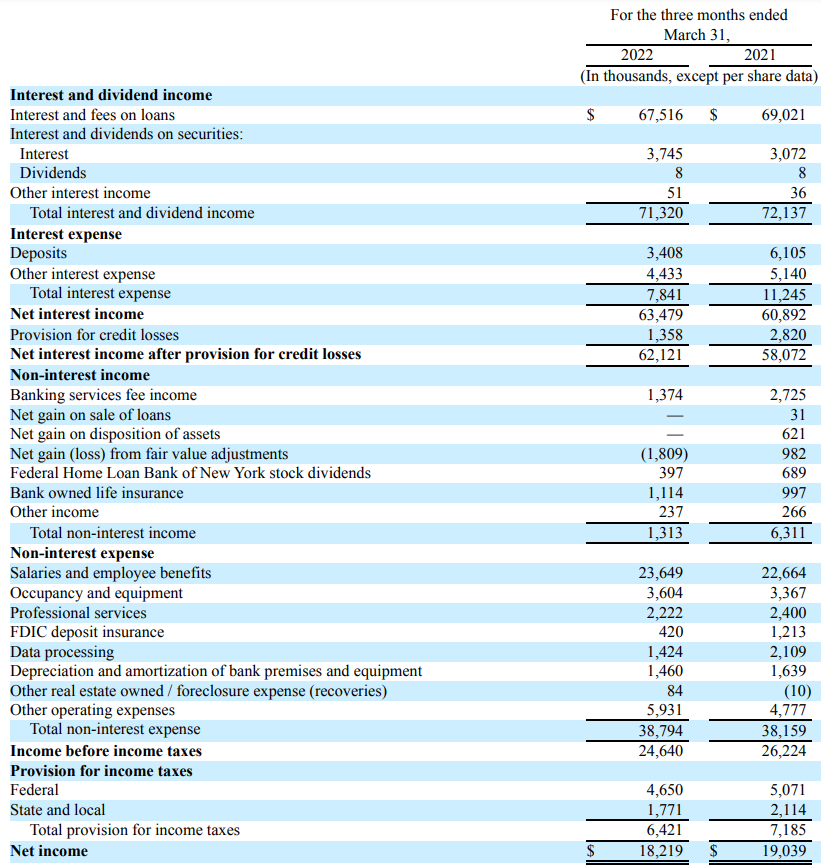

Flushing Fiscal without a doubt continue to is a reasonably compact financial institution as the overall stability sheet consists of significantly less than $8.2B in property even though the equity benefit is a lot less than $700M. But you don’t have to be a massive lender to be profitable, and Flushing was able to improve its net fascination money in the very first quarter of this 12 months.

Even though the desire revenue reduced from $72.1M to $71.3M, the overall sum of interest expenditures decreased at an even faster rate, from $11.2M to $7.8M which resulted in an improve of the internet fascination income by just about 5% to $63.5M. Many thanks to the sturdy mortgage e book and very lower LTV ratios, the financial institution was as soon as again capable to hold the allowance for financial loan reduction provisions really very low: in the very first quarter of this year, it only recorded just below $1.4M in provisions.

FFIC Investor Relations

As the lender is a ‘pure’ industrial lender seeking to make dollars on the distinction between the desire it pays on deposits and the interest it expenses on financial loans, the non-desire earnings is exceptionally low advert just $1.3M in the to start with quarter. To be fair, this bundled a $1.8M strike from the honest worth changes on financial loans and that designed the final result appear a minimal bit worse than it in fact is. Also, the lender pointed out it incurred about $4.3M of non-recurring expenses in the initial quarter.

The overall sum of non-fascination expenses remained somewhat stable (which is an accomplishment taking into consideration the inflationary tension we are seeing somewhere else which brought about salaries to enhance), and the bottom line reveals a pre-tax revenue of $24.6M. Right after shelling out the taxes owed on this, the web cash flow documented by Flushing Financial in the very first quarter of this yr was $18.2M for an EPS of $.58. On an annualized foundation, the EPS could now be predicted to exceed $2.30 this 12 months as the raising interest prices ought to produce some additional tailwinds for Flushing. On leading of that, Flushing has been acquiring back again shares which means the net revenue will have to be divided in excess of much less shares outstanding and that will also offer a great enhance to the for each-share effectiveness. Flushing just lately introduced the improve of the overall sizing of the buyback system. The company had .35M shares remaining underneath the former approval but the board of directors has increased the whole amount of money of shares that could be repurchased by 1M. And as FFIC is shopping for again inventory at a fee of around 20,000 shares for every week, the financial institution need to be happy to gobble up shares at just $22.

The latest quarterly dividend is $.22 for every share resulting in a generate of around 4%. That is really great thinking of the payout ratio is significantly less than 40% of the earnings.

Flushing is ready to take advantage of the bigger desire costs

Most scaled-down banks feel to be investing about 20-30% of their asset foundation in dollars or securities but Flushing Financial has only invested 13.5% of its stability sheet in all those property. And which is high-quality as just one could argue its exceptionally low regular LTV ratio on the financial loan e book indicates its loan reserve must be safer than its peers as it can keep the personal loan losses limited.

FFIC Investor Relations

As of the end of March, only $26.3M of the financial loans had been categorised as ‘past due’ which is fewer than .4% of the total volume of loans excellent ($6.6B). The whole allowance for loan losses now recorded by the lender exceeds $37M so even if all financial loans would default and the financial institution would foreclose on the belongings with no recouping a solitary dollar, the latest volume of mortgage loss allowance ought to already be sufficient to include these losses. But again, with lower LTV ratios across the portfolio, Flushing must be in a fantastic placement to keep the fallout constrained.

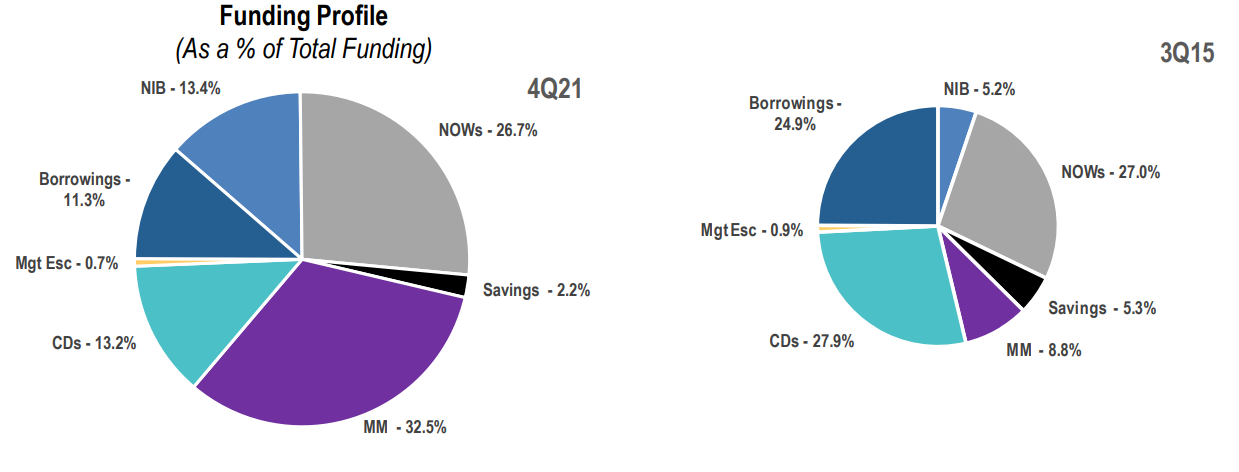

FFIC Investor Relations

Flushing Financial also explained why it thinks it is in a much better place to start out the existing cycle of expanding fascination prices in comparison to 2015. Its funding profile is now more diversified with just 24.6% of the funding provided by CDs and borrowings. These are normally larger-value sources of funding and weigh on the internet interest revenue and that’s why Flushing was not entirely capable to capture the gains of the fascination level cycle in 2015 when in excess of 50% of its funding resources arrived from CDs and borrowings.

In accordance to flushing, every single 50 base level boost in the desire fees without the need of a corresponding maximize in the deposit charges would include $5M for each calendar year to the internet desire revenue. If we would now suppose the web desire margin increases by 100 bp, it’s effortless to see Flushing really should be capable to increase a few dozen cents for every calendar year to its base line many thanks to the bigger interest costs.

Investment decision thesis

I like the way the Flushing Economic management is jogging the company. Basically, shopping for the stock of a bank is purchasing a basket of loans when hoping that basket is run well by the management. And it’s not normally quick to locate a lender whose basket of financial loans matches with your individual investment decision standards.

A single may well detest New York authentic estate but with an normal LTV ratio of around 38%, Flushing Financial ought to be pretty shielded from a deteriorating New York genuine estate marketplace. Flushing is presently trading at just a fraction around its tangible e book worth, and I think this is a superior moment to build a long position. I have been seeking to produce set selections on FFIC but thanks to the incredibly reduced volumes and vast spreads that hasn’t been effective, so I must possibly just obtain the stock outright.